Construction is becoming an information management process. The more accurate, quality and complete the data, the more efficient the design, calculations, cost estimates, erection and operation of buildings. In the future, the key resource will not be a crane, concrete and rebar, but the ability to collect, analyze and use information.

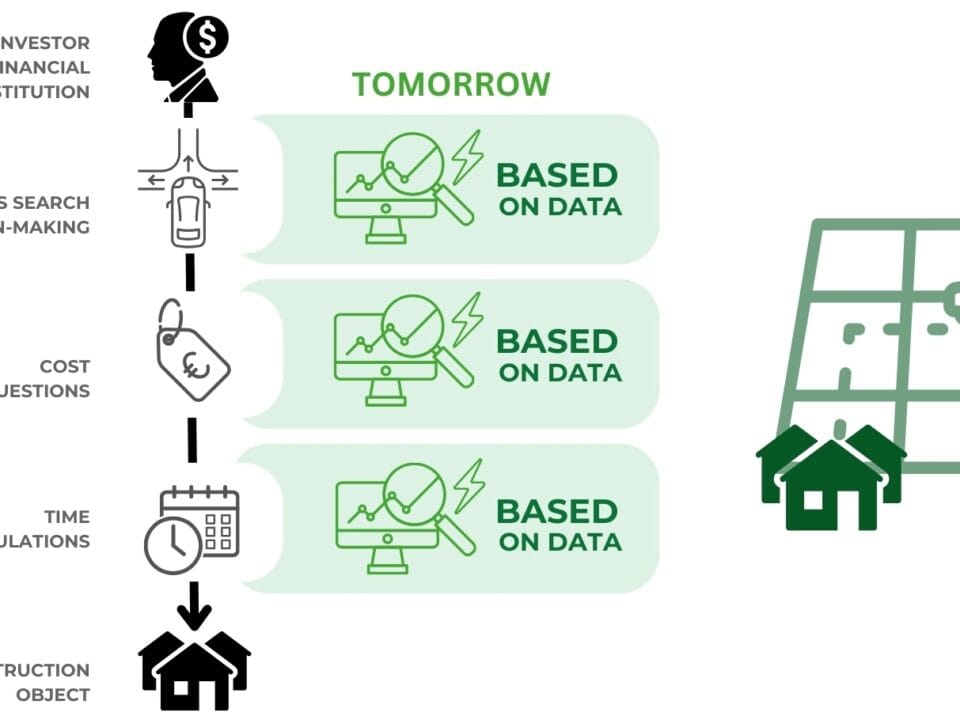

In the future, construction company clients – investors and clients financing construction – will inevitably utilize the value of open data and analytics of historical data. This will open up opportunities to automate the calculation of project timelines and costs, without involving construction companies in costing issues, which will help control costs and identify redundant costs more quickly.

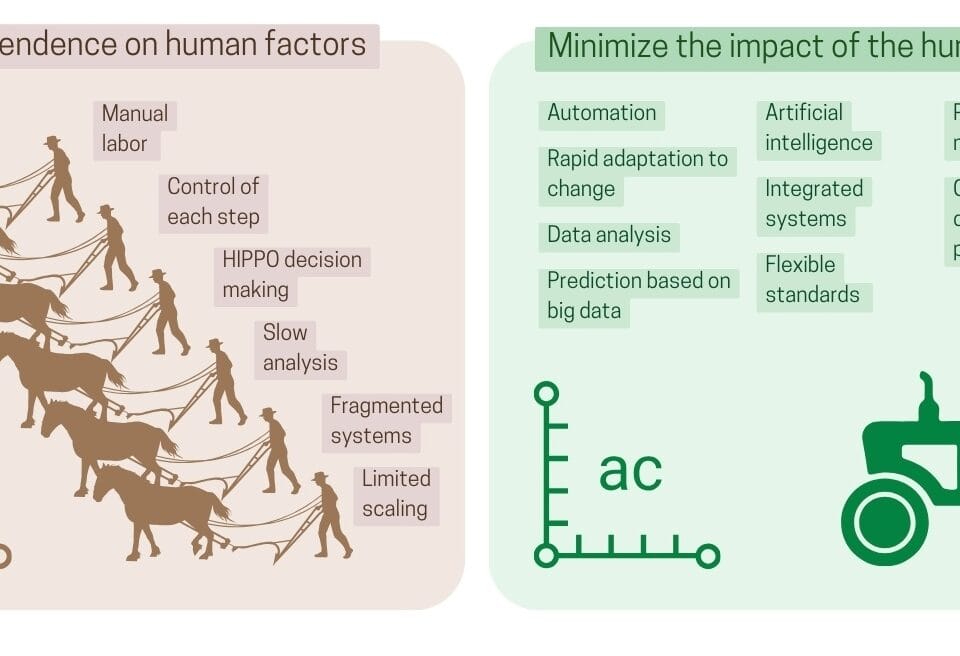

Imagine a construction site where laser scanners, quadcopters and photogrammetry systems collect accurate real-time data on concrete volumes used. This information is automatically converted into simple flat MESH -models with metadata, bypassing cumbersome CAD (BIM) systems, without dependencies on complex geometric kernels, ERP or PMIS. These data, collected from the construction site, are centrally transferred to single structured repositories, available to the client for independent analysis, where real prices from different construction stores are uploaded and for example various parameters – from the rate of credit financing to dynamically changing factors such as weather conditions, stock exchange quotations of construction materials, logistics tariffs and statistical seasonal fluctuations in labor prices. Under such conditions, any discrepancies between the design and actual volumes of materials become instantly obvious, making it impossible to manipulate estimates both at the design stage and when the project is delivered. As a result, the transparency of the construction process is achieved not through an army of supervisors and managers, but through objective digital data, in which the human factor and the possibility of speculation will be minimized.

In the future, this kind of data control work will rather be done by data managers on the customer side (Fig. 1.2-4 CQMS manager). This is especially true for calculations and project estimates: where there used to be a whole department of estimators, tomorrow there will already be machine learning and forecasting tools that will set price limits for construction companies to fit into.

Given the fragmented nature of the [construction] industry, where most of the systems and subsystems are supplied by SMEs, the digital strategy must come from the customer. Clients must create the conditions and mechanisms to unlock the digital capabilities of the supply chain (Accenture, “Building More Value With Capital Projects,” 1 January 2020).

– Andrew Davis and Giuliano Denicol, Accenture “Creating more value through capital projects”

Such openness and transparency of data poses a threat to construction companies, which are used to making money from opaque processes and confusing reports, where speculation and hidden costs can be hidden behind complex and closed formats and modular proprietary data platforms. Therefore, construction companies, as in the case of vendors promoting Open Source solutions, are unlikely to be interested in fully implementing open data into their business processes. If the data is available and easy to process for the customer, it can be checked automatically, which will eliminate the possibility of overestimating volumes and manipulating estimates.

According to the World Economic Forum report “Shaping the Future of Construction” (2016) (W. E. Forum, “Forum Shaping the Future of Construction – A Landscape in Transformation:,” January 1, 2016), one of the key problems of the industry remains the passive role of the client. Nevertheless, it is the customers who should take greater responsibility for the outcome of projects – from early planning, to selecting sustainable interaction models, to monitoring performance. Without the active participation of project owners, systemic transformation of the construction industry is impossible.

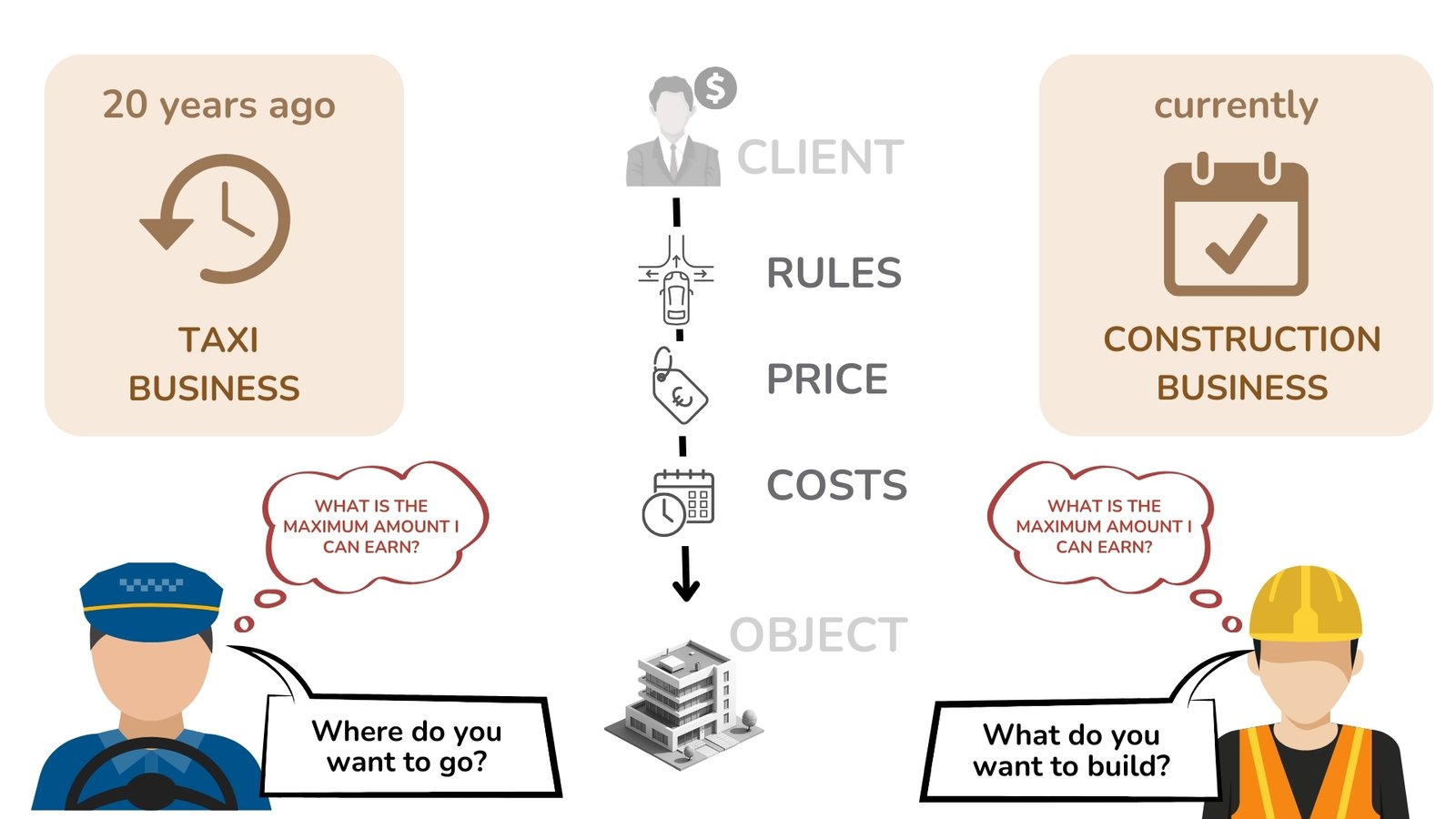

The loss of control over volume and cost calculations has already transformed other industries over the past 20 years, allowing customers to directly, without intermediaries, to stymie their goals. Digitalization and data transparency have transformed many traditional business models, such as cab drivers with the advent of Uber (Fig. 10.1-4), hoteliers with the arrival of Airbnb and retailers and stores with the rise of Amazon, and banks with the rise of neo-banks and decentralized fintech ecosystems, where direct access to information and the automation of time and cost calculations have significantly reduced the role of intermediaries.

The process of democratization of access to data and tools for their processing is inevitable, and over time, open data on all project components will become a customer requirement and a new standard. Therefore, the introduction of open formats and transparent calculations will be promoted by investors, customers, banks and private equity funds (private equity) – those who are the end users of the built objects and then operate the object for decades.

Major investors, clients and banks are already demanding transparency in the construction industry. According to Accenture’s study “Creating more value through capital projects” (2020) (Accenture, “Building More Value With Capital Projects,” 1 January 2020), transparent and reliable data is becoming a decisive factor for investment decisions in construction. As experts note, trustworthy and effective project management is impossible without transparency, especially in times of crises. In addition, asset owners and contractors are increasingly moving toward contracts that incentivize data sharing and collaborative analytics, reflecting growing demands from investors, banks and regulators for accountability and transparency.

The movement of the investor, the customer from idea to finished building, in the future will be akin to traveling on autopilot – without a driver in the form of a construction company, promises to become independent of speculation and uncertainty.

The era of open data and automation will inevitably change the construction business just as it has already done in banking, commerce, agriculture and logistics. In these industries, the role of intermediaries and traditional ways of doing business are giving way to automation and robotization, leaving no room for unjustified mark-ups and speculation.

The data and processes in all human economic activities are no different from what professionals in the construction industry have to deal with. In the long term, construction companies, which today dominate the market by setting price and service quality standards, may lose their role as a key intermediary between the customer and their construction project.